LNG: growth expected in 2021 & new possibilities with FROG-XT2

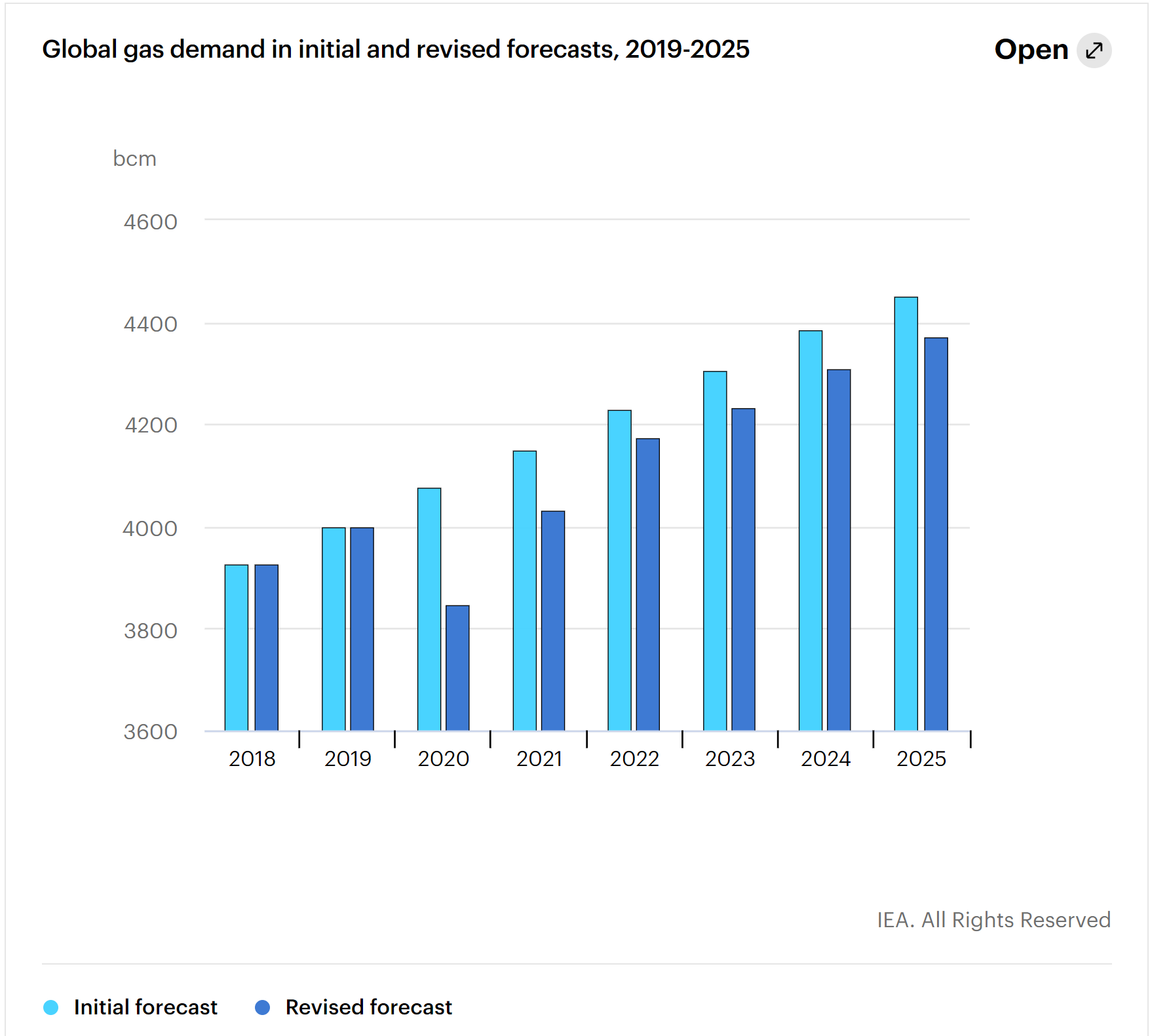

With half the CO2 emissions of coal, natural gas is deemed to be much more environmentally friendly and in the recent years has gained a lot more attention and investment as a potential transition energy source. The beginning of 2020 saw Shell’s LNG Outlook report: “Global demand for liquefied natural gas (LNG) grew by 12.5% to 359 million tonnes in 2019 - a significant increase that bolsters LNG’s growing role in the transition to a lower-carbon energy system.”1 However, the global pandemic and economic downturn later saw the whole of oil & gas industry struggling with a major drop in demand, including the LNG market. The impact of 2020 crisis is expected to have repercussions on the medium-term growth potential, resulting in about 75 bcm of lost growth over the forecast period, 2019 to 2025, according to the IEA2.

The latest reports expect the industry to rebound slightly by the end of 2020, however, we are yet to see if this accounts for the effects of the 2nd wave of pandemic currently taking its toll, particularly in Europe. Nonetheless, demand levels are expected to return to pre-crisis levels in 2021 and demand in emerging markets would benefit from lower natural gas prices.2 While the US’ LNG exports have seen a rise in August (110.2 billion cubic feet (Bcf) in August, up from 96.1 Bcf in July, according to he latest data from the U.S. Department of Energy) the volumes are still nearly 20% lower than in August last year. Asia remains the largest importer of the USA’s LNG with top importers being Japan, South Korea, China and India3. The Asia Pacific region is also predicted to account for over half of global gas consumption thanks to growth of India and China over the next 10-20 years, however, again, this will depend on the rate of recovery of these countries post-pandemic2.

Despite the turbulent market, the vast majority of projects carry on and new developments are progressing (albeit some with delays). “More than 90 liquefied natural gas shipments were being lifted this week at global liquefaction plants as the US saw 12 cargoes departing from its facilities and the North Asia spot LNG price moved above the $6.00 mark” and Australia’s 9-month total LNG exports were higher this year than last, despite the global crisis, according to LNG Journal4.

LNG is one of the fastest growing industries in the energy sector and innovations to improve operations are always welcome. Safe and cost-efficient crew transfer is an area that has always been quite challenging for operators in this segment. On one hand, it is an activity not performed too frequently which means investing in costly equipment is seen as non-essential and is questioned. On the other hand, some transfers are performed in open sea and can be difficult when sea states or weather conditions are not favourable. Add to this the limited space on the deck of LNG carriers or FSRUs as well as cranes with a limited load capacity and the options are limited.

The R&D team at Reflex Marine recognized these challenges. To date, our WAVE-4 was the preferred option among our clients in the LNG market segment. It was the carrier of choice for the first FSRU in Bangladesh (Summit FSRU) as well as on the Yamal Spirit LNG vessel.

Teekay LNG STS transfer: WAVE-4 carrier was used to transfer passengers from the Yamal Spirit to the Rudolf Samoylovich in the Arctic

Teekay LNG STS transfer: WAVE-4 carrier was used to transfer passengers from the Yamal Spirit to the Rudolf Samoylovich in the Arctic

While our WAVE-4 carrier is suitable for many of the crew transfer needs, our latest product – the FROG-XT2 carrier – addresses the small landing area challenge. FROG-XT2 is a personnel transfer carrier for 2 seated passengers. It has the smallest footprint of any rigid personnel transfer carrier available on the market (almost 15% smaller than the previous smallest in class footprint of WAVE-4). It belongs to Reflex Marine’s renowned FROG-XT range therefore it boasts the highest operational envelope and highest standard of passenger protection. Contoured profile and buoyancy panels protecting the passengers from side collision translate to increased safety of crew transfer even within restricted landing areas.

You can read more about the FROG-XT2 carrier here.

Alternatively, for higher volume transfers, consider the complete range of Reflex Marine carriers with different capacities: WAVE-4 (for 4 standing passengers) and other models in the FROG-XT range with capacities for 4, 6 or 10 seated passengers.

References:

2 https://www.iea.org/reports/gas-2020/2021-2025-rebound-and-beyond

3 https://www.kallanishenergy.com/2020/10/19/us-lng-exports-begin-recovery-in-august/